Five things you should know about 'one tax for one nation'

04:22AM Fri 30 Jun, 2017

FirstPost | By IndiaSpend Team

The government is all set to roll out the goods and services tax (GST) at the stroke of the midnight on 30 June, 2017.

All states/union territories, except Jammu & Kashmir, have approved the state goods & services Act (SGST) for ensuring the roll out.

Source:GST Council

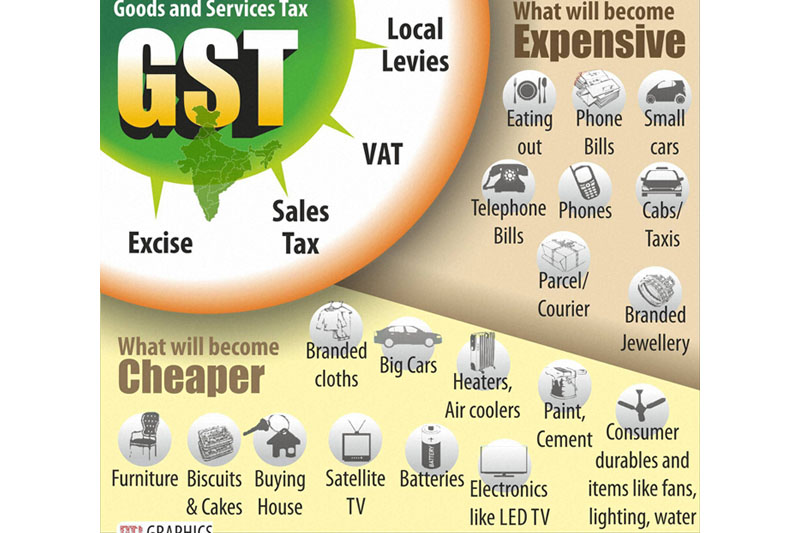

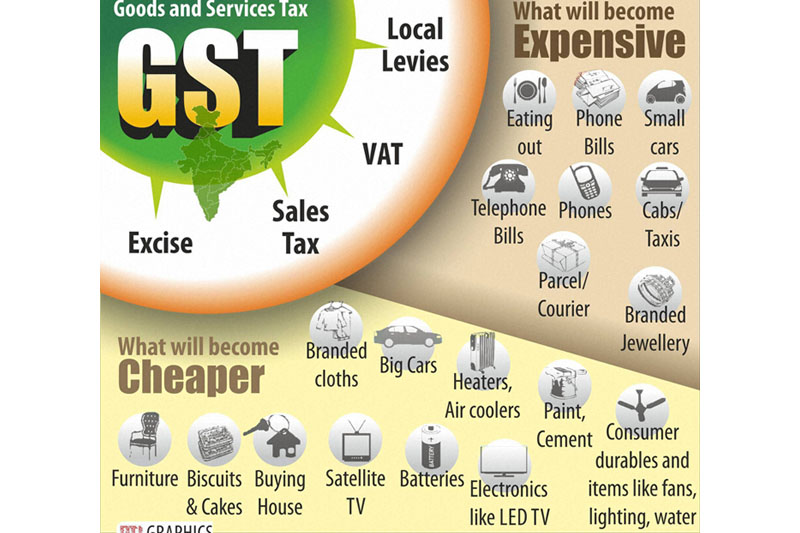

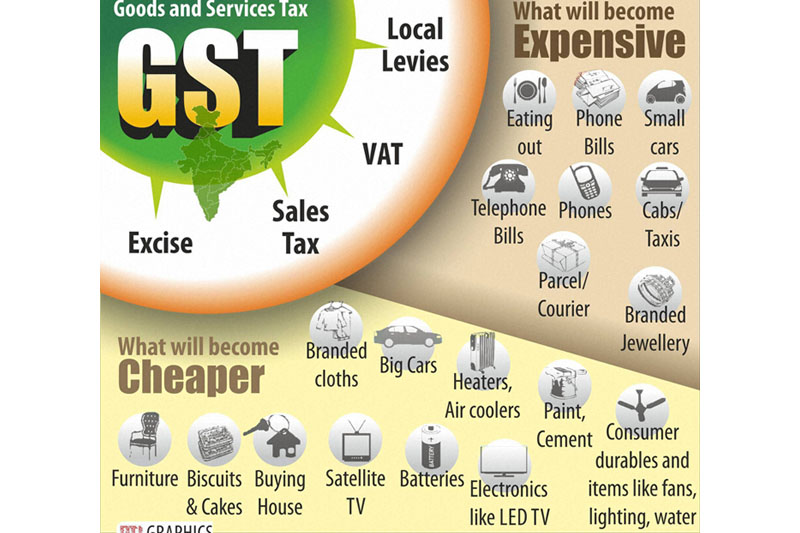

[caption id="attachment_144561" align="aligncenter" width="800"] NEW DELHI : GOODS AND SERVICES TAX. PTI GRAPHICS(PTI8_8_2016_000297B)[/caption]

Here are five things you must know ahead of the big change in indirect taxation across the country

1) What exactly is GST?

GST is paid when a consumer buys something (even a company buying inputs). The tax is levied on every transaction in the supply of goods and services, barring certain exempted items such as petroleum products. The tax levied at one stage can be set off or deducted from the tax to be paid at the next stage.

India has a dual GST–Central GST (CGST) and State GST (SGST). There is also an integrated GST (IGST) on the inter-state supply of goods and services, which can be set off against CGST and SGST that is to be paid.

From July 1, 2017, India will move to a one-tax, one-nation regime. All goods and services will be taxed under one of four slabs–5%, 12%, 18% and 28%–wherever they are purchased.

2) Who decides GST rates?

NEW DELHI : GOODS AND SERVICES TAX. PTI GRAPHICS(PTI8_8_2016_000297B)[/caption]

Here are five things you must know ahead of the big change in indirect taxation across the country

1) What exactly is GST?

GST is paid when a consumer buys something (even a company buying inputs). The tax is levied on every transaction in the supply of goods and services, barring certain exempted items such as petroleum products. The tax levied at one stage can be set off or deducted from the tax to be paid at the next stage.

India has a dual GST–Central GST (CGST) and State GST (SGST). There is also an integrated GST (IGST) on the inter-state supply of goods and services, which can be set off against CGST and SGST that is to be paid.

From July 1, 2017, India will move to a one-tax, one-nation regime. All goods and services will be taxed under one of four slabs–5%, 12%, 18% and 28%–wherever they are purchased.

2) Who decides GST rates?

The GST Council including the union finance minister (who will be the chairman of the council) and the state finance ministers will finalise the GST rates.

3) Where do you register for GST?

The Goods and Services Tax Network (GSTN), a non-government, private company with the central government holding 24.5 percent stake, will provide IT infrastructure and support services to the governments, taxpayers and other service providers for the implementation of GST.

4) Relaxation in rules for two months

The GST council has relaxed the tax filing norms for two months–July & August, 2017–for those still maintaining manual records or in the process of GST transition.

The council has finalised a simplified form instead of invoice-wise returns, according to this release by the Central Board of Excise & Customs, the government department overseeing the implementation of GST. There would be no late fees or penalties for late returns, and regular returns would need to be filed from September.

The GST Council including the union finance minister (who will be the chairman of the council) and the state finance ministers will finalise the GST rates.

3) Where do you register for GST?

The Goods and Services Tax Network (GSTN), a non-government, private company with the central government holding 24.5 percent stake, will provide IT infrastructure and support services to the governments, taxpayers and other service providers for the implementation of GST.

4) Relaxation in rules for two months

The GST council has relaxed the tax filing norms for two months–July & August, 2017–for those still maintaining manual records or in the process of GST transition.

The council has finalised a simplified form instead of invoice-wise returns, according to this release by the Central Board of Excise & Customs, the government department overseeing the implementation of GST. There would be no late fees or penalties for late returns, and regular returns would need to be filed from September.

Source:GST@GoI

5) Which items are covered under GST and which are not subject to GST?

Daily use consumer items such as cereals, pulses, dairy produce, fresh meat, fish, fresh vegetables and fruits are all exempt from GST, according to government data.

Education and skill development services have also been granted exemption, official data show.

Alcoholic drinks, electricity and five petroleum products (crude oil, petrol, diesel, natural gas and aviation turbine fuel) are out of the purview of GST. These will continue to attract VAT and central excise. The petroleum products have been excluded only temporarily.

Education and skill development services have also been granted exemption, official data show.

Alcoholic drinks, electricity and five petroleum products (crude oil, petrol, diesel, natural gas and aviation turbine fuel) are out of the purview of GST. These will continue to attract VAT and central excise. The petroleum products have been excluded only temporarily.

| Benefits Of GST | |

|---|---|

| Trade | Consumers |

| Reduction in multiplicity of taxes | Simpler tax system |

| Mitigation of cascading/double taxation | Reduction in prices of goods & services due to elimination of cascading |

| Development of common national market | Uniform prices throughout the country |

| Simpler tax regime | Increase in employment opportunities |

NEW DELHI : GOODS AND SERVICES TAX. PTI GRAPHICS(PTI8_8_2016_000297B)[/caption]

Here are five things you must know ahead of the big change in indirect taxation across the country

1) What exactly is GST?

GST is paid when a consumer buys something (even a company buying inputs). The tax is levied on every transaction in the supply of goods and services, barring certain exempted items such as petroleum products. The tax levied at one stage can be set off or deducted from the tax to be paid at the next stage.

India has a dual GST–Central GST (CGST) and State GST (SGST). There is also an integrated GST (IGST) on the inter-state supply of goods and services, which can be set off against CGST and SGST that is to be paid.

From July 1, 2017, India will move to a one-tax, one-nation regime. All goods and services will be taxed under one of four slabs–5%, 12%, 18% and 28%–wherever they are purchased.

2) Who decides GST rates?

NEW DELHI : GOODS AND SERVICES TAX. PTI GRAPHICS(PTI8_8_2016_000297B)[/caption]

Here are five things you must know ahead of the big change in indirect taxation across the country

1) What exactly is GST?

GST is paid when a consumer buys something (even a company buying inputs). The tax is levied on every transaction in the supply of goods and services, barring certain exempted items such as petroleum products. The tax levied at one stage can be set off or deducted from the tax to be paid at the next stage.

India has a dual GST–Central GST (CGST) and State GST (SGST). There is also an integrated GST (IGST) on the inter-state supply of goods and services, which can be set off against CGST and SGST that is to be paid.

From July 1, 2017, India will move to a one-tax, one-nation regime. All goods and services will be taxed under one of four slabs–5%, 12%, 18% and 28%–wherever they are purchased.

2) Who decides GST rates?

Representational image. Reuters

| Accounts & Records In GST Regime |

|---|

| 1) Compliance verification in GST will be done through examination of accounts and records maintained, only if required |

| 2) One tax, one type of record: No need to maintain separate records for different taxes like value added tax, Excise & Service Tax |

| 3) The required records are: a) All records of goods and services that a person supplies or receives in the course of his business; b) All records of goods imported; c) Any other supporting documents such as contracts and price quotation to show liability to GST |

| 4) Taxable persons with turnover of less than Rs 2 crore are not required to get their accounts audited or submit reconciliation statement with annual returns |

Education and skill development services have also been granted exemption, official data show.

Alcoholic drinks, electricity and five petroleum products (crude oil, petrol, diesel, natural gas and aviation turbine fuel) are out of the purview of GST. These will continue to attract VAT and central excise. The petroleum products have been excluded only temporarily.

Education and skill development services have also been granted exemption, official data show.

Alcoholic drinks, electricity and five petroleum products (crude oil, petrol, diesel, natural gas and aviation turbine fuel) are out of the purview of GST. These will continue to attract VAT and central excise. The petroleum products have been excluded only temporarily.